Two wallet waves: Apple Pay vs. Google Wallet

Apple Pay and Google Wallet are transforming digital payments across the Western Balkans, from Serbia’s early adoption to recent launches in Kosovo, Albania, and North Macedonia. Using Pikasa Analytics’ real-time media monitoring tools and data analytics for media, this report explores how media coverage analytics and sentiment analysis reveal differences in awareness, audience engagement, and brand reputation monitoring. The findings highlight how AI-powered media analysis tracks the fintech shift toward mobile wallets, digital transformation in banking, and payment modernization across Europe.

Launch timelines

Apple was absent from the Western Balkans until a rapid wave in 2024–25. Montenegro’s CKB bank activated the service in 2024, followed by NLB Banka Podgorica and Slovenia’s NLB d.d. later that spring. Serbia had a head start: ProCredit and Raiffeisen banks introduced Apple Pay on 30 June 2020, leveraging the country’s contactless infrastructure. Bosnia & Herzegovina and Kosovo joined on 29 July 2025, Albania on 4 August 2025 and North Macedonia prepared for a September 2025 launch. Each rollout was accompanied by press releases from banks and regulators emphasizing digital transformation and European integration.

Google’s strategy was more staggered. In August 2022 the company expanded Google Wallet to six new countries including Serbia, making it one of the earliest adopters. A year later Google’s developers announced that the wallet launched on 6 June 2023 in Montenegro, North Macedonia, Bosnia & Herzegovina and Albania. ProCredit Bank Albania noted that it was the first local bank to implement Google Pay and that customers could make contactless payments with their Android phones. Finally, Kosovo joined the list on 27 September 2024. By the time Apple Pay rolled out in late 2025, Google Wallet had been available in much of the region for over a year, though not widely publicized.

Adoption vs. awareness

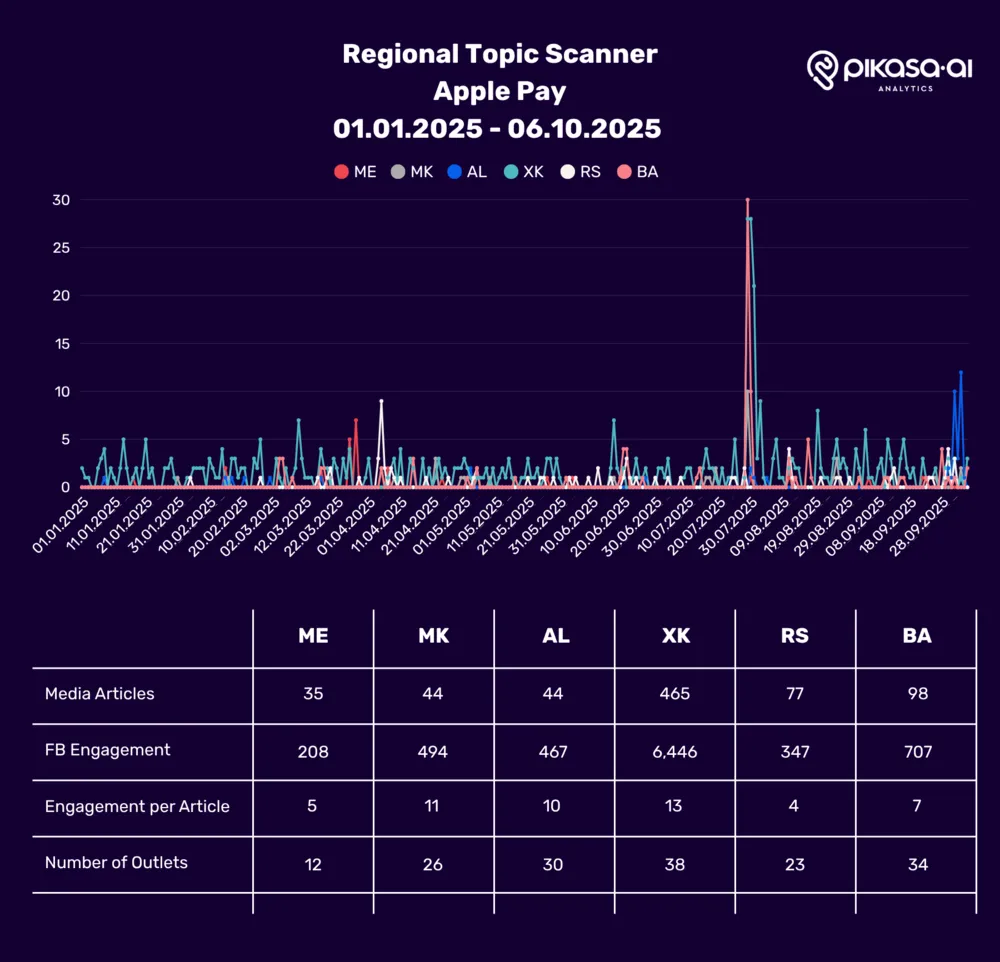

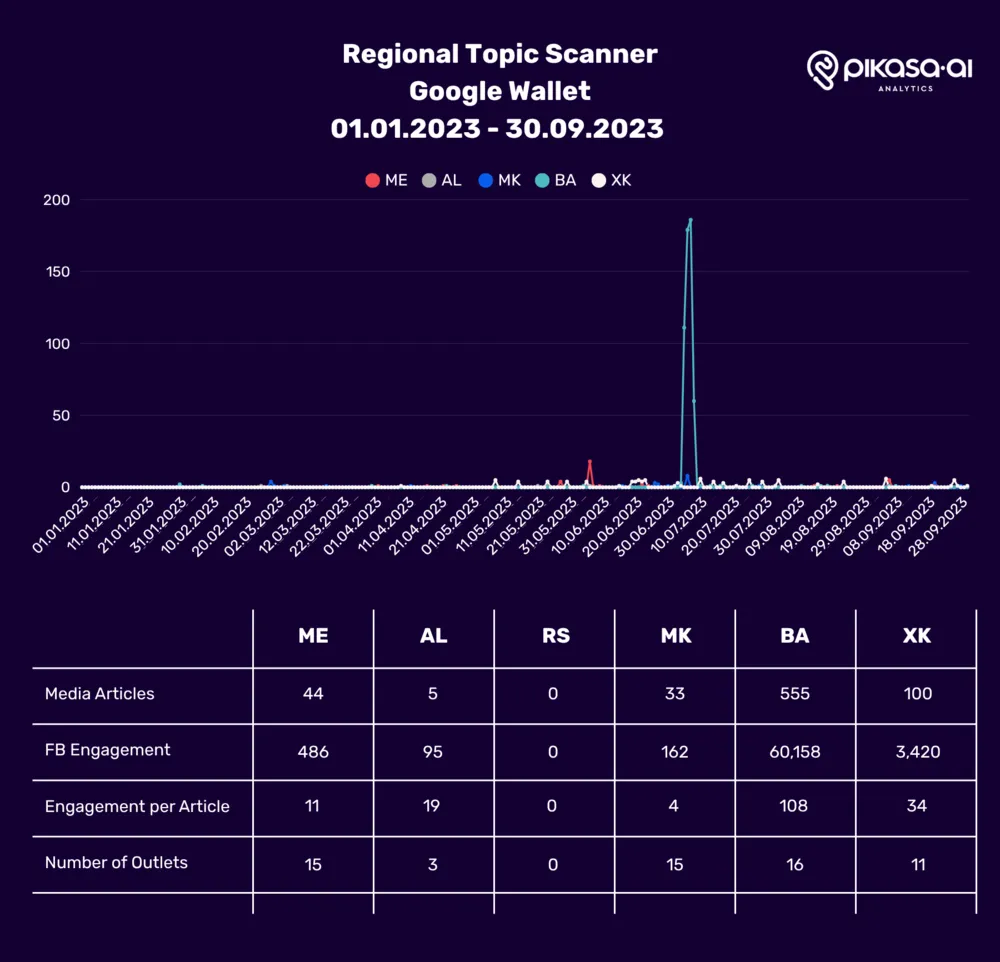

Comparing the two services using Analytics.Live we revealed a disconnect between availability and visibility. Apple Pay enjoyed an explosive media spike when Bosnia & Herzegovina and Kosovo announced their launches in July 2025. Hundreds of articles and social media posts appeared almost overnight; Kosovo alone generated more than 400 stories and thousands of reactions as local portals covered the news. In contrast, Google Wallet’s earlier rollouts drew muted coverage. During the first nine months of 2023 only 44 Montenegrin articles about the service were tracked, compared with 555 Bosnian articles about Apple Pay in 2025.

The charts below illustrate the disparity. The first shows Apple Pay coverage across countries; the second captures Google Wallet attention. Notice how Apple’s timeline is compressed but intense, whereas Google’s buzz is sporadic and often swallowed by unrelated viral stories.

Who talked about what

Analytics.live showed that the spike in Apple Pay conversation was driven by a handful of outlets. In Montenegro Investitor and Antena M published how‑to guides and bank announcements. North Macedonia’s Sloboden Pechat led with 211 social engagements, while Albania’s Gazeta Telegraf generated buzz by explaining that Apple Pay works for Mastercard holders. In Kosovo, Kallxo and Indeks online posts attracted hundreds of interactions, and Serbia’s tabloid Kurir dominated the discussion.

Google Wallet coverage was far more modest. In Montenegro, bank‑focused sites such as Bankar and Vijesti led the conversation with articles explaining that Erste Bank customers could use Google Pay. Albania’s Klan newspaper ran a widely shared story titled “For the first time in Albania - digital payment with Google Pay from any Android phone”. North Macedonia, Bosnia & Herzegovina and Kosovo saw little wallet‑specific coverage; the high engagement numbers in Bosnia came almost entirely from Dnevni avaz’s sports and celebrity news. By the time Kosovo gained official support in September 2024, attention had shifted to other topics.

Themes across both launches

Across both wallets, Pikasa Analytics identified several narrative threads that emerged:

- How‑to education: Many early stories were instructional, guiding users through wallet setup and listing supported banks. Titles like “Forget wallets and cards – here’s how to pay with your mobile phone” signaled both curiosity and a need for consumer education.

- Bank press releases: Announcements by NLB, CKB, ProCredit, Erste and other banks dominated early coverage. These releases framed mobile wallets as milestones in digital transformation and highlighted partnerships with Apple or Google.

- Lifestyle and tech: Some articles paired wallet launches with iPhone releases or broader tech trends (AI‑powered payment agents). This lifestyle angle helped normalize contactless payments.

- Regulatory endorsement: Central banks (notably Kosovo’s) issued statements presenting mobile wallets as steps toward payment modernization and alignment with European standards. Such endorsements build consumer trust and encourage adoption.

- Anticipation pieces: In markets where launches were pending (e.g., North Macedonia for Apple Pay), speculation about which banks would go live generated steady interest even before official rollouts.

Market impact and what’s next

Mobile wallets arriving across the Western Balkans signal a structural shift in how money moves, well beyond any single provider.

For consumers, tokenized, device-based payments raise security and convenience while making cross-border travel and e-commerce simpler.

Merchants and SMEs gain higher checkout conversion, less cash handling, and more competition on acquiring fees, especially in tourism hubs and marketplaces serving the diaspora.

Banks accelerate digital onboarding and card activation, deepen mobile engagement, and modernize risk with tokenization and device authentication.

Fintechs and PSPs can layer services, installments, loyalty, expense tools, on top of wallet rails. And for regulators and policymakers, wallet adoption complements SEPA alignment and instant-payments rollouts, pushing interoperability, consumer protection, and financial-inclusion goals.

What to watch next

The pace of bank enablement, real merchant acceptance on the ground, interplay between global wallets and bank/telecom wallets, instant-payments integration, and the impact on remittances and cross-border commerce. Whether it’s Apple Pay, Google Pay, or local wallets, the bigger story is a regional pivot to secure, tokenized, mobile-first payments, and the competitive, consumer, and policy changes that follow.

Written by

Natasha Dimova

October 08, 2025