The analysis of social media channels for shopping malls in Bulgaria and North Macedonia offers valuable insights into the evolving consumer landscape in these regions. By examining the number of followers and engagement metrics on platforms like Facebook and Instagram, this study provides a snapshot of the malls' online popularity.

The analysis of social media channels for shopping malls in Bulgaria and North Macedonia offers valuable insights into the evolving consumer landscape in these regions. By examining the number of followers and engagement metrics on platforms like Facebook and Instagram, this study provides a snapshot of the malls' online popularity.

Our recent analysis of shopping malls in Bulgaria and North Macedonia has revealed fascinating insights into their online presence and the demographics of their engaged audiences on Facebook and Instagram.

Divergent Engagement Rates

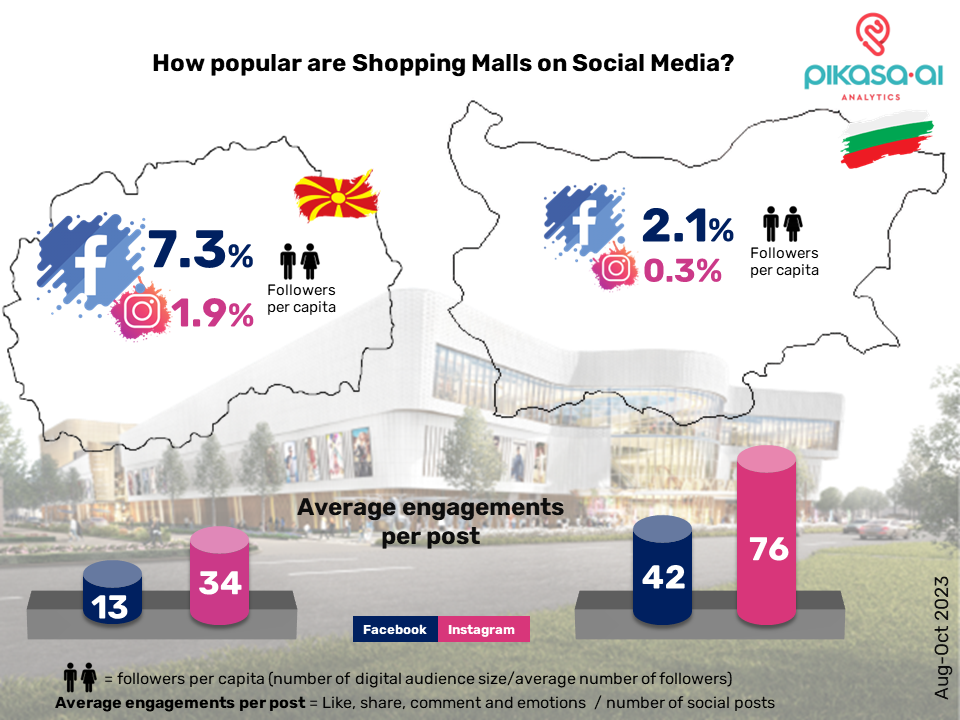

One of the standout findings from our research is the significant disparity in engagement rates between the two countries. In North Macedonia, approximately 7.3% of the digital audience has shown their support by following shopping mall Facebook pages, whereas in Bulgaria, this percentage is notably lower, at 2.1%. This suggests a more robust online following for shopping malls in North Macedonia, reflecting a higher level of interest and engagement within the local community. A similar trend emerges on Instagram, with North Macedonia boasting an impressive 1.9% of its digital audience following shopping malls, while Bulgaria lags behind at 0.3%. This data indicates that Instagram, known for its visual appeal and engagement potential, is also a channel where North Macedonia's shopping malls have successfully captured the interest of a larger portion of the population.

Demographics and Targeting

Understanding these variations in social media engagement is essential for shopping malls to fine-tune their marketing strategies. They can use these insights to tailor content and campaigns, with a focus on resonating with their specific demographic audiences. It's crucial to dig deeper into the demographics of these engaged populations to create content that speaks directly to the interests and preferences of these individuals.

In conclusion, our analysis provides a valuable glimpse into the social media landscape for shopping malls in Bulgaria and North Macedonia. The differences in engagement rates indicate unique opportunities and challenges in each market. To stay competitive and continue fostering strong online communities, shopping malls in both countries should continue to leverage social media as a powerful tool for engagement, customer connection, and brand promotion. Furthermore, analyzing demographics and crafting tailored content will be key to ensuring long-term success in this dynamic digital age.

Facebook Engagement

In North Macedonia, the average number of reactions per post on shopping mall Facebook pages stands at 13, which, while respectable, pales in comparison to the significantly higher 42 average reactions per post recorded in Bulgaria. This suggests a more active and engaged audience in Bulgaria, where each post generates a substantially greater response from followers.

Instagram Engagement

A similar pattern emerges on Instagram, with North Macedonia's shopping malls garnering an average of 34 engagements per post, including likes, comments, and shares. In contrast, Bulgaria enjoys an even more impressive average of 76 engagements per post. These numbers demonstrate that Instagram posts for shopping malls in Bulgaria are not only more frequent but also have a stronger impact on the audience, fostering more interaction and engagement.

Key Takeaways

These disparities in engagement rates provide valuable insights into the effectiveness of marketing strategies in these two countries. Bulgaria's shopping malls are evidently more successful in driving audience participation and reaction, possibly due to the use of more compelling content, targeted campaigns, or a deeper understanding of their customer base.

For North Macedonia, this data could serve as a benchmark for improvement, highlighting the potential for enhancing their online presence and engagement strategies. It's crucial for shopping malls in both countries to take these engagement statistics into account and use them as a foundation for refining their social media approaches, crafting content that resonates more deeply with their respective audiences, and fostering an active online community.

In summary, while the disparity in average engagements is evident, this analysis underscores the dynamic nature of social media engagement in Bulgaria and North Macedonia and offers a roadmap for shopping malls to adapt and thrive in these distinct online landscapes.

Methodology

Pikasa used its analytics.live media intelligence platform to conduct real-time online monitoring of more than 3000 media in the Western Balkans Region, Bulgaria, Moldova, Ukraine, Kazakhstan, Belarus and Baltic countries.

The analytics platform monitors media articles along with their respective penetration on social network platforms (Facebook, Instagram, YouTube, TikTok, LinkedIn, Telegram, VK and Odnoklassniki) counting all types of activities and engagements.