This analysis by Pikasa Analytics analyzes how Greek banks communicate across online media and social media, revealing key differences in visibility, engagement, and narrative control. Using real-time media monitoring and social listening data from Pikasa's, Analytics.Live, platform, the analysis compares media coverage versus owned social channels to uncover trends in digital transformation, marketing campaigns, economic narratives, and risk communication in the Greek banking sector.

In January 2026, Greek banks maintained strong visibility across both online media and social media, but not in the same way or for the same reasons. This analysis examines how banks are covered by the media versus how they choose to communicate directly with audiences on their own digital channels. Conducted by Pikasa Analytics through its real-time platform Analytics.Live in Greece, the study highlights clear contrasts in topic emphasis, engagement priorities, and narrative control, revealing how banks strategically use each channel to balance accountability, reputation, and public engagement.

When things go wrong, media speaks loud - Banks choose reassurance

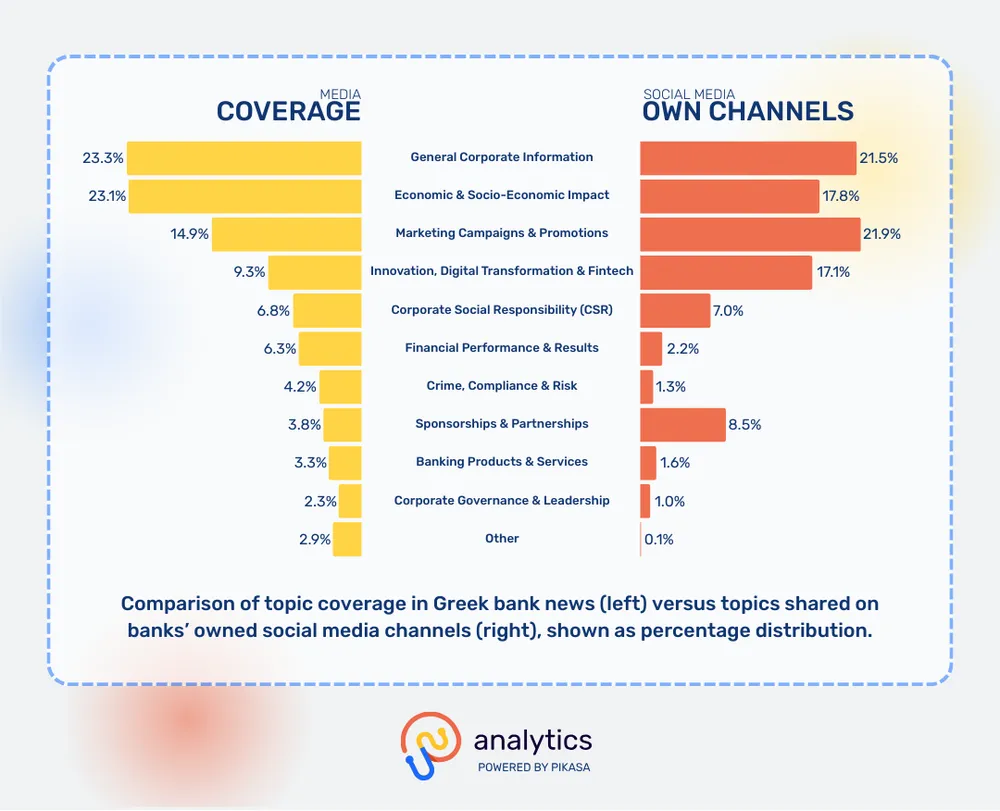

Crime, compliance, and risk-related topics account for 4.19% of total media coverage, compared to only 1.3% of banks’ social media content, clearly showing how differently these issues are handled across channels.

Traditional media focuses on investigations, fraud cases, and regulatory scrutiny, fulfilling its watchdog role and responding to public concern. In January 2026, National Bank of Greece dominated this narrative, particularly around the spy SMS fraud case, which generated strong engagement across outlets such as in.gr, Newsit, and News 24/7. These stories examined transaction traces, institutional responses, and broader compliance implications.

On social media, however, banks avoid amplifying such incidents. Instead, institutions like Eurobank and Piraeus Bank shared general cybersecurity advice and fraud-prevention tips, keeping messaging educational and reassuring rather than reactive.

Campaigns go social: Engagement wins where Media can’t compete

Marketing campaigns and promotions account for 21.9% of all bank social media posts, compared to 14.87% of media coverage, clearly positioning social platforms as the primary engagement channel for Greek banks.

Banks increasingly rely on TikTok and Instagram to communicate through emotional storytelling, entertainment, and incentives - formats designed to drive interaction rather than traditional publicity. In January 2026, Eurobank’s €πιστροφή loyalty campaign stood out as the most impactful initiative, reaching 1.4 million views on TikTok by highlighting everyday customer rewards in short, relatable videos. The same bank also invested in behind-the-scenes storytelling, presenting employees and internal processes in a more human and transparent way, a format that generated 581,900 views and strengthened emotional connection with audiences.

At the same time, Piraeus Bank successfully combined banking communication with national sports enthusiasm through its Olympiacos BC ticket contest, which reached 1.5 million views on TikTok by pairing basketball highlights with interactive giveaways. In a more emotion-driven approach, Snappi’s “Blue Monday” campaign used storytelling combined with tangible rewards to engage users on Instagram, attracting 157,631 views and encouraging sharing during a traditionally low-mood period.

These campaigns demonstrate that content combining emotion, participation, and clear value significantly outperforms traditional promotional messaging on social media.

Banks let media explain the Economy, while they explain what It means for People

Economic and socio-economic topics account for 23.13% of media coverage, but only 17.8% of banks’ social media posts, reflecting a deliberate division in communication roles.

Media outlets focus on macroeconomic indicators, interest rates, market performance, and policy impact. During January 2026, Piraeus Securities and National Bank of Greece were frequently cited in articles analyzing stock market returns exceeding 20%, lending growth expectations, and overall economic stability.

On social media, banks reframed these developments into accessible narratives. Alpha Bank and Eurobank, for example, focused on how economic trends translate into financing opportunities for businesses, exporters, and households, using simplified visuals and short explanatory videos.

Digital transformation is where Banks choose to lead the narrative

Innovation, fintech, and digital transformation content represents 17.1% of social media posts, almost double its 9.28% share in media coverage, showing where banks actively choose to shape perception.

In January 2026, National Bank of Greece and Piraeus Bank promoted digital payment solutions, app functionality, and technology integration initiatives across social platforms. Eurobank also highlighted digital tools supporting exporters and businesses, linking innovation to economic opportunity.

Meanwhile, media coverage focused more broadly on fintech trends, partnerships, and market disruption, often without the practical, user-focused framing seen on social channels.

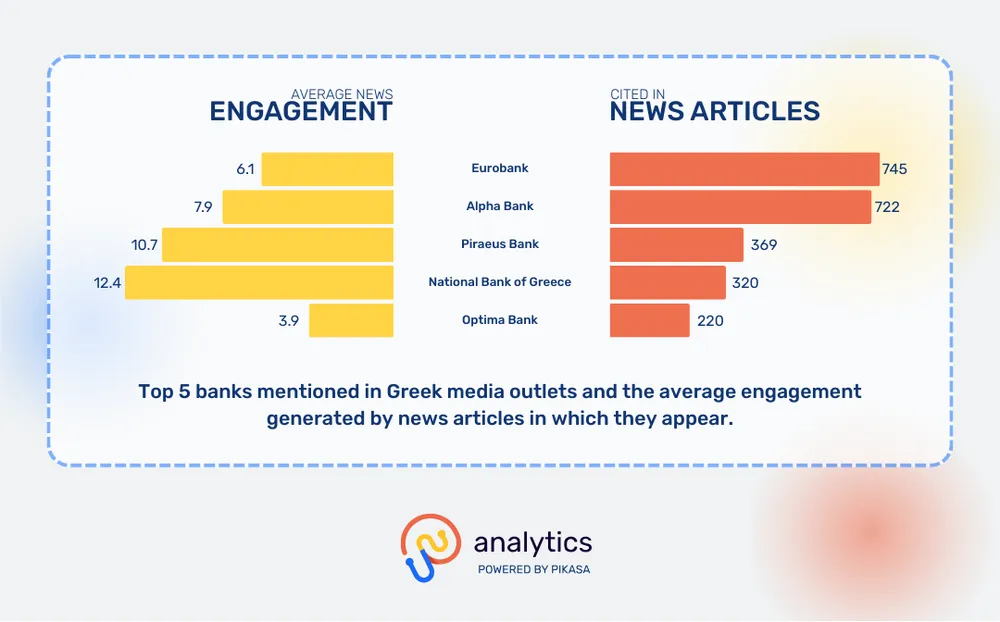

Mentioned banks in news articles vs. Average number of news engagements

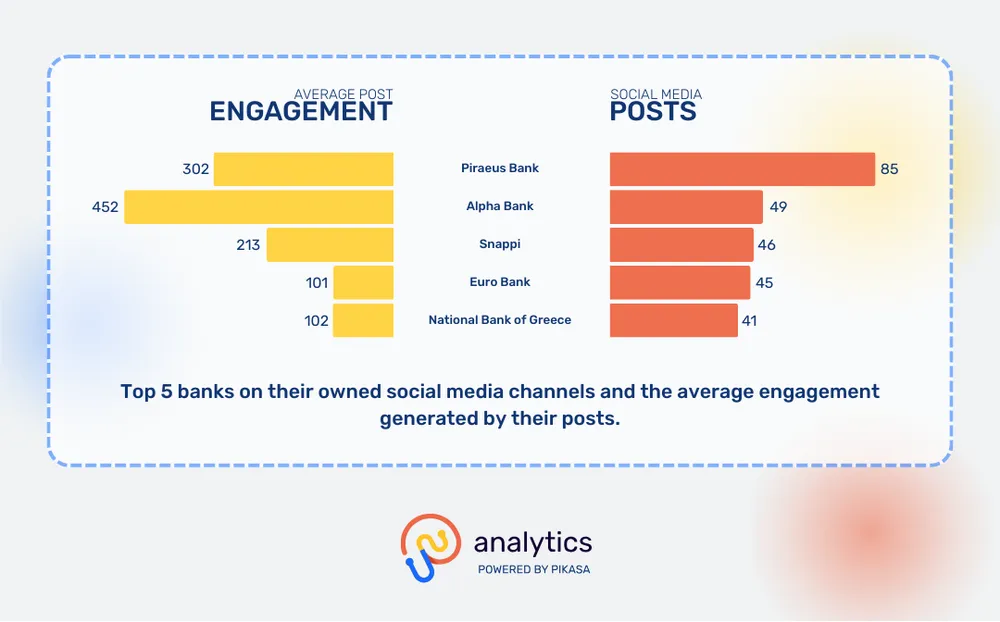

Most active banks on Social Media vs. Average number of engagements on Social Media

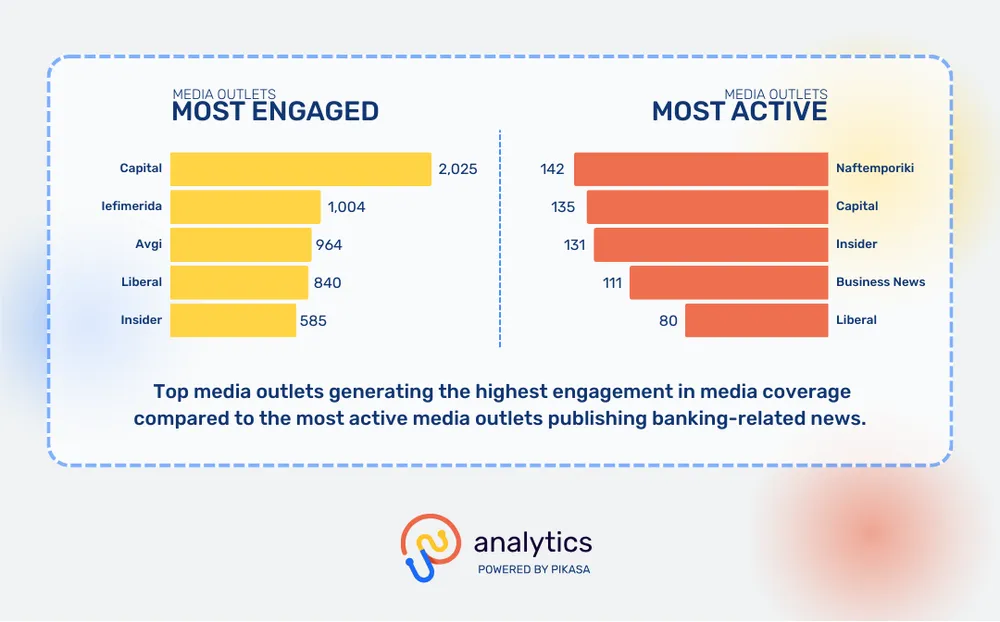

Activity vs. Engagement in Banking Media Coverage

Conclusion

The findings show a deliberate and mature communication strategy by Greek banks. Traditional media remains the primary space for scrutiny, economic analysis, and risk-related reporting, while social media is used to build trust, drive engagement, and humanize financial institutions through campaigns, innovation, and storytelling. High-performing initiatives such as Eurobank’s €πιστροφή campaign and Piraeus Bank’s sports-driven promotions demonstrate how banks successfully connect with audiences by focusing on emotion, participation, and everyday relevance. Overall, the analysis confirms that Greek banks do not communicate less on social media - they communicate differently, using each channel with clear intent to shape perception and strengthen long-term brand credibility.

Written by

Meriton Nagavci

February 10, 2026